Comparison Group Reporting with BPC and OneStream

Comparison of SAP S/4 HANA Group Reporting, BPC, and OneStream

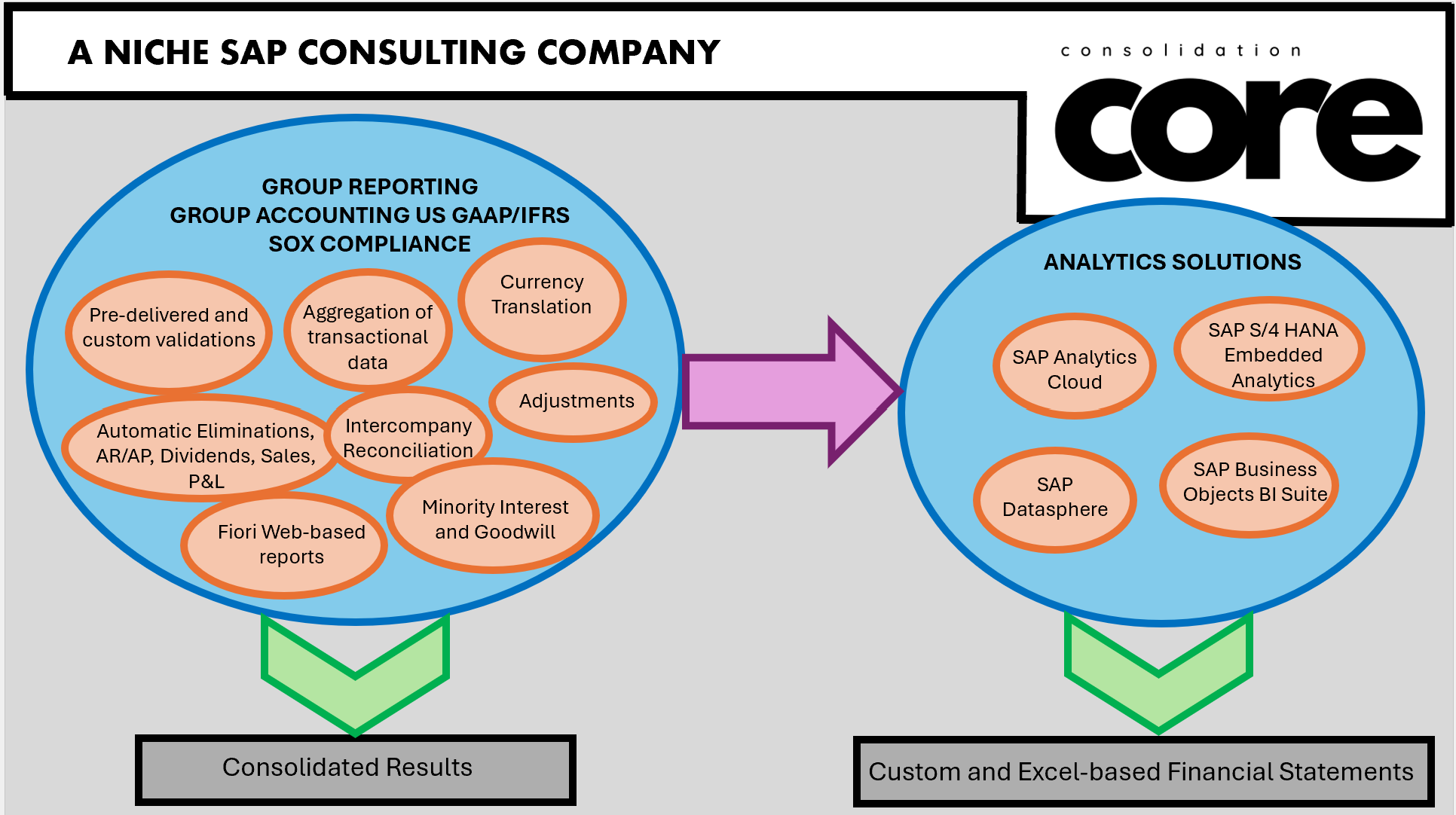

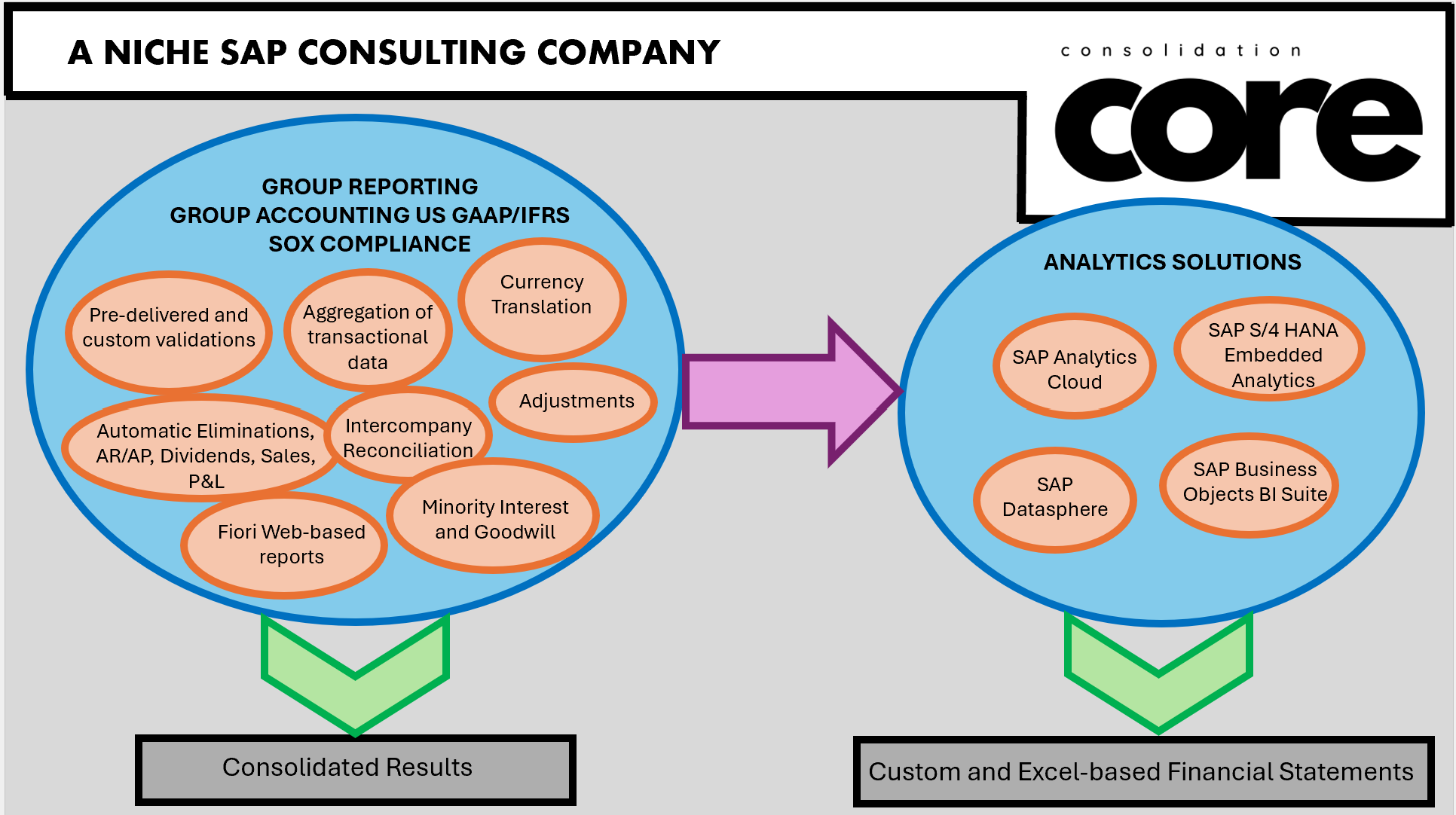

This topic encompasses complex aspects. It is important to recognize that while SAP S/4 HANA Group Reporting, Business Planning and Consolidation (BPC), and OneStream all fall within the Enterprise Performance Management (EPM) domain, they serve distinct functions. BPC and OneStream primarily focus on analytics and planning, whereas Group Reporting (GR) is an accounting tool designed to ensure accurate categorization, validation, and balancing data from the initial submission by local accountants to the final corporate monthly close with the last group validation. Group Reporting has been developed to satisfy the complex requirements of the corporate monthly close and comply with US GAAP and/or IFRS standards.

Group Reporting is super precise and geared towards providing functionalities that local accountants need to produce a trial balance with data integrity and assist the corporate accounting team in calculating complex eliminations and adjustments. It ensures users do not make contextually incorrect postings or enter erroneous data. Group Reporting excels in precision, making it ideal for accountants who value easy tracking and auditing. It handles complex calculations related to changes in capital structure, mergers and acquisitions, divestitures, step acquisitions, and more. Users provide "control data" in a flat file, and the system automatically posts complex elimination entries, starting with equity against investments and any delta being posted to goodwill.

Unlike Group Reporting, BPC and OneStream require more developer intervention for scripting and involve more manual processes. BPC is favored by finance professionals due to its flexible and user-friendly Excel interface, which allows for easy report creation through drag-and-drop features. It offers high adaptability similar to using a whiteboard where various tasks can be completed with scripting. However, Group Reporting does not offer the Excel-based interface provided by BPC. Instead, it should be viewed as an additional solution, with alternatives such as SAC Analytics, Analysis for Office, or other partner-provided Excel-based interfaces.

Clients should utilize these standard customization options, avoiding the necessity for ABAP or API work, which are considered standard within the framework. For clients implementing S/4 HANA, the integration of master and transactional data, coupled with cost-efficiency, makes Group Reporting a preferred choice, particularly given SAP's favorable package deals. When properly configured and utilized to their full potential, Group Reporting ensures compliance, internal control, and audit readiness, requiring only occasional one-off adjustments.

Notably, Group Reporting pre-delivers all security roles, such as “local accountant” and “corporate accounting manager.” The Data Monitor is developed to enable local accountants to manage the entire process of providing their monthly data. Local accountants run tasks in the Data Monitor for both SAP and non-SAP entities, including loading data with correct trading partners, balancing trial balances, and performing custom validations. Tasks such as “Release Universal Journal” for SAP entities and “Data Collection” for non-SAP entities ensure an equal net income calculation from the Profit & Loss statement to the retained earnings in the balance sheet. Corporate accounting teams monitor progress in the Data Monitor and, upon submission of data by local accountants, streamline the data with currency translation, intercompany eliminations, and automatic consolidation of investments.

Group Reporting also has a pre-delivered solution for eliminating intercompany profit in inventory whereas the other mentioned EPM solutions will have that functionality built from scratch by IT technical support. In summary, Group Reporting and BPC/OneStream are distinct tools with unique functionalities. SAP enthusiasts who appreciate precision and conciseness will find Group Reporting highly satisfactory. Additionally, a robust Excel-based reporting solution can be built upon Group Reporting. SAP is moving towards enabling business users to independently manage their Group Reporting platform without needing extensive IT support. Changes in Master Data, such as the consolidated chart of accounts, organizational hierarchy adjustments, Balance Sheet and P&L hierarchy changes, and Cash Flow adjustments, are all designed for finance professionals to handle directly.

It is worth mentioning that OneStream is gaining popularity among finance professionals for similar reasons as BPC. However, OneStream, like BPC, does not integrate with S/4 HANA, presenting similar challenges. Overall, it represents a mindset adjustment: Group Reporting provides comprehensive control, compliance, and minimized risk through its precise and pre-delivered processes, whereas OneStream, much like BPC, is comparable to a versatile "whiteboard."

OneStream requires significant investment and is complex to implement. Licensing and implementation costs can be substantial. While intuitive for finance teams, the technical aspects may necessitate additional training (e.g., cube design, XF Marketplace). Compared to other CPM tools, OneStream may require extra effort for integration with certain ERP and business applications. It demands a dedicated team for maintenance and optimization. As a newer player, OneStream has fewer experienced professionals and resources available for support compared to established competitors.

SAP Insider LAS VEGAS 2025 – Addressing Clients’ Pain Points in the Corporate Close Process through Group Reporting

The SAP community demonstrated remarkable unity and enthusiasm during the event. The engagement of SAP experts, whether from the client or vendor side, was impressive. The energy and passion of this event continue to resonate.

Consolidation Core established several meaningful connections, enhancing our understanding of solutions and adjacent services. Staying informed about market trends and clients’ needs remains our foremost priority.

We attended all “Group Reporting (GR)” sessions and observed a significant interest among clients in implementing GR shortly. They posed thought-provoking questions, which are summarized below:

1) How can we persuade Finance professionals within our organization to adopt GR and upgrade from BPC?

Clients expressed challenges in convincing their Finance departments to transition from BPC to GR, particularly given Finance directors’, managers’, and analysts’ preference for BPC’s Excel-based interface and ease of report creation and navigation.

2) How can we seamlessly integrate non-SAP subsidiaries into an interconnected S/4 HANA landscape?

Concerns have been raised about integrating non-SAP entities, as not all subsidiaries use SAP systems. Given that SAP promotes its S/4 HANA integration capabilities, clients may assume that integrating non-SAP entities would be challenging. However, GR has pre-delivered capabilities for such integration, considering it is common for organizations to have subsidiaries that are not on SAP or will not be for some time.

3) What functionalities does GR offer regarding the elimination of Intercompany Profit in Inventory?

Clients from various industries (Manufacturing, Pharmaceuticals, Technology and Electronics, Energy and Chemicals, etc.) with complex requirements sought detailed information on GR’s capabilities in eliminating Intercompany Profit in Inventory.

4) What alternatives are available for an Analytics solution to enhance GR?

Another prominent topic was the Analytics solution for GR, as the pre-delivered Fiori reports lack user-friendliness. Fortunately, we identified an exceptional partner specializing in an Excel-based interface compatible with any SAP transaction or Fiori Tile. Please inquire for more details.

We will address these pain points in our upcoming blogs. Stay tuned for further insights!

Is Group Reporting a “Reporting” Tool?

SAP Group Reporting is not an analytics solution. This article clarifies its true role in the close process and the common misconceptions that derail implementations.

SAP has introduced an intriguing name for its long-standing consolidation engine application: “Group Reporting” (GR). This tool represents the culmination of several evolutionary cycles from its predecessors, including ECCS, SEM-BCS, and BPC. GR incorporates various functionalities, with its core capabilities established decades ago. Notable advancements include seamless integration with S/4 HANA, facilitating shared Master Data and Transactional Data among connected modules. Additionally, the implementation of Fiori reports, which are web-based, along with integration with SAC Analytics and Planning, are noteworthy updates.

So, how do we address whether GR is a reporting tool? The answer is nuanced. GR’s primary mission is to enable, streamline, and automate the monthly corporate close process, ensuring compliance with US GAAP or IFRS. It addresses complexities such as special currency translation for equity and movements for the Cash Flow statement and automates eliminations for AR/AP, Sales, Dividends, and P&L.

A key feature is the automatic consolidation of investments, which allows the system to manage complex ownership structures, calculating minority interest and goodwill. This is especially valuable in industries characterized by dynamic mergers, ownership restructuring, acquisitions, and divestitures, such as Financial Services, Insurance, Technology, Energy, Utilities, Media, and Telecommunications. Automatic calculations enhance data control and integrity significantly.

Other notable features include the Intercompany Matching and Reconciliation Tool (ICMR), enabling real-time reconciliation of AR/AP transactions, and custom validations that focus on data integrity and quality specific to each organization.

It also enables consolidation by profit center, treating each profit center as an individual unit. This approach facilitates segment reporting, which is essential for Financial Planning and Analysis (FP&A). Consolidated actuals by segment serve as the critical starting point for each forecast cycle.

Following the execution of tasks in the Data and Consolidation Monitor—which streamline, translate, unify, validate, and eliminate data—users should ideally obtain perfectly consolidated financial statements, such as the consolidated Balance Sheet and P&L. However, challenges arise with the “out-of-box” reports provided by the Web-based Fiori apps. These reports often require customization to align with the client’s Master Data and suffer from limited formatting options, leading clients to export data to Excel for final adjustments.

While SAP offers Analytics solutions that complement GR’s consolidated results, it is important to note that these require additional modules and development skills. SAC Analytics complements GR effectively and provides an Excel Add-in. However, each client's system landscape varies, necessitating a comprehensive assessment before recommending the appropriate Analytics tool to accompany GR.

Group Reporting vs Analytics